Visitor identification remains a critical part of inbound growth.

What has changed is that identification alone no longer creates an advantage.

Buying cycles are compressing, with the average B2B sales cycle dropping from 11.3 months in 2024 to 10.1 months in 2025. Buyers move faster, gather information earlier, and delay direct engagement with sales.

By the time visitors reach your site, they are often well informed and closer to a decision than teams assume.

In this environment, data enrichment alone does not bridge the gap between first visit and revenue.

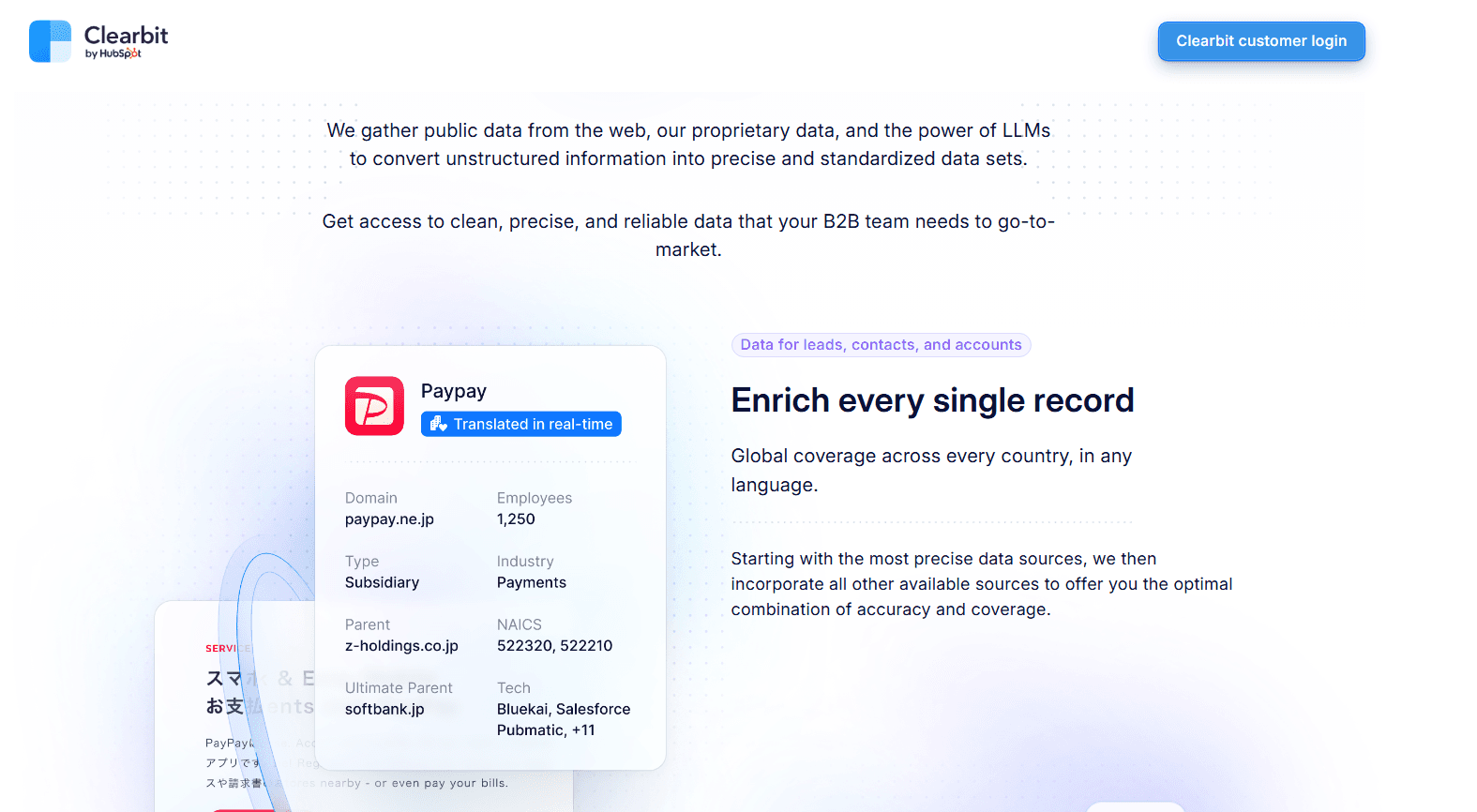

Clearbit already set the benchmark for enrichment accuracy and coverage. The limitation is not data quality, but how slowly most teams operationalize that data once intent appears.

Knowing who visited your site is now table stakes. What matters is how quickly and intelligently that signal turns into qualification, routing, and pipeline.

This shift explains why more teams are evaluating Clearbit alternatives. Not because Clearbit underperforms, but because enrichment without execution no longer matches modern inbound expectations.

This guide breaks down where Clearbit continues to excel, where friction appears, and which Clearbit alternatives better support revenue teams focused on inbound execution.

Where Clearbit Fits and Where Revenue Teams Get Stuck

Clearbit remains one of the strongest enrichment tools on the market. Its limitations are not about data quality. They are about workflow ownership.

Where Clearbit performs well

Clearbit excels at structured enrichment use cases.

Teams rely on it for form shortening, firmographic completion, and keeping CRM records consistent across Salesforce and HubSpot.

For RevOps teams focused on data hygiene, lead scoring consistency, and enrichment at scale, Clearbit continues to deliver strong value. Its APIs are stable, well-documented, and widely adopted.

This is why Clearbit remains deeply embedded in many B2B data stacks.

Where the gap appears for revenue teams

The challenge begins after identification.

Clearbit tells you who is visiting and enriches the record.

It does not engage visitors, qualify intent, or move deals forward. Acting on that data requires additional systems.

Most teams layer Clearbit with chat tools, routing logic, SDR workflows, and sales engagement platforms. Each layer adds handoffs, latency, and operational overhead.

Clearbit’s pricing model and the limits of enrichment quality

As inbound expectations rise, a fragmented enrichment-led approach becomes increasingly expensive.

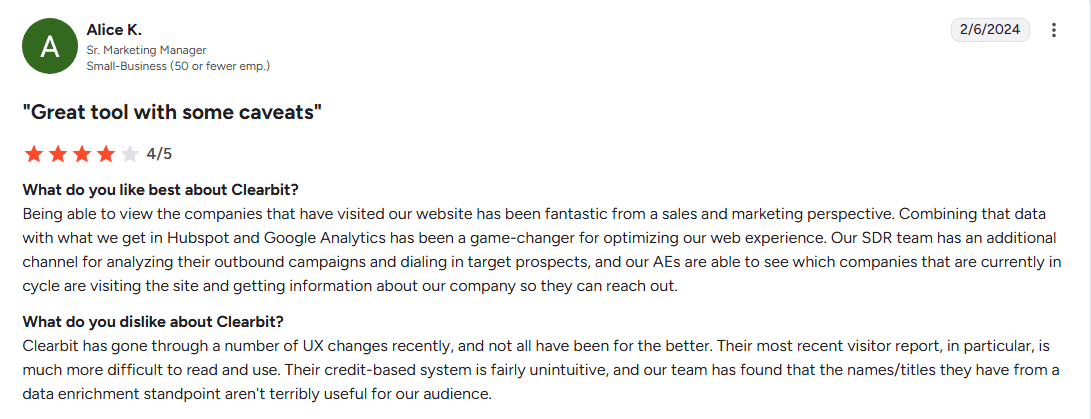

Clearbit’s pricing is tied to data usage, which can escalate quickly for high-traffic sites without a proportional increase in pipeline or conversion. At the same time, data quality is not always as consistent as teams expect.

Multiple G2 reviews note issues such as outdated firmographics, incorrect company matches, or incomplete records, especially at scale.

These gaps create additional cleanup work for RevOps and reduce confidence in downstream automation.

While teams manage enrichment costs and data validation, high-intent buyers often wait hours or days for meaningful follow-up.

In that window, competitors respond faster, or buyers self-educate and move forward without sales involvement.

Clearbit solves the enrichment problem well in principle.

What it does not solve is execution speed, orchestration across tools, or accountability for turning enriched data into a pipeline.

This is where a new category of inbound platforms comes into play.

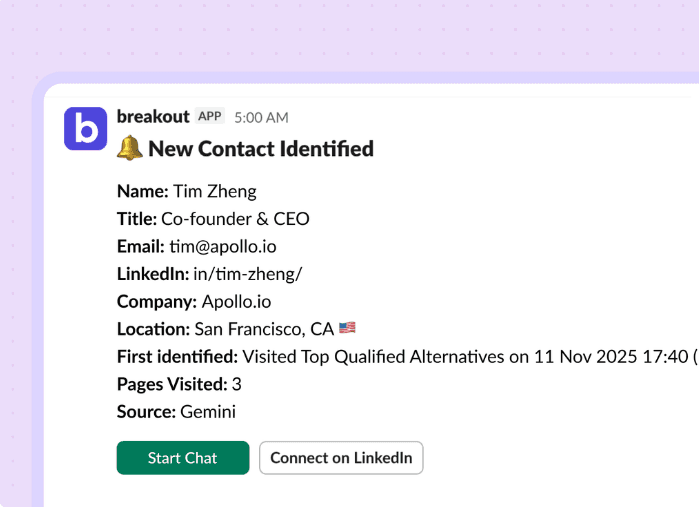

Breakout is built to close the gap Clearbit leaves open.

It connects real-time identification directly to qualification, routing, and action through an AI SDR.

Instead of enriching data and handing it off, Breakout engages buyers immediately. It qualifies intent during the visit and automatically moves opportunities forward.

Unlike Clearbit’s usage-based enrichment pricing, Breakout’s value-based model aligns cost with pipeline impact, not raw data volume.

For revenue teams, the shift is subtle but important.

The goal is no longer better data enrichment. It is faster and more consistent execution at the moment the intent appears.

Top Clearbit Alternatives in 2026: How They Approach Deanonymization and Enrichment

Most Clearbit alternatives improve one specific dimension of the workflow. Some focus on scale. Others focus on account intelligence or intent signaling.

Few attempt to own the entire path from identification to pipeline creation.

Understanding these differences is critical for teams deciding whether they need better enrichment or a fundamentally different inbound system.

1. Breakout: an AI revenue platform built for inbound execution

Breakout approaches deanonymization as the starting point, not the outcome.

Instead of stopping at identification or alerts, it uses enrichment data to trigger immediate qualification and action through an AI SDR.

The platform engages visitors during the session, using real-time context to qualify intent and move buyers forward without forms or manual SDR involvement.

Actions such as CRM updates, routing, sequencing, and meeting booking happen automatically through deep two-way integrations.

Breakout is designed for teams that want inbound traffic to create a pipeline, not just data.

Pros

Real-time visitor and company deanonymization

Autonomous AI SDR that qualifies and routes without human intervention

Deep two-way integrations with Salesforce and HubSpot

Can push leads directly into Outreach or Salesloft

Replaces fragmented stacks built from multiple tools

Cons

Not a standalone contact list or outbound database

Optimized primarily for inbound-led growth motions

Pricing

Value-based pricing. Not tied to raw API or enrichment volume. Predictable costs for high-traffic websites

Verdict

Breakout is best used when inbound is a primary growth channel and speed-to-pipeline matters. It is ideal for teams that want to replace fragmented workflows with a single execution layer.

2. ZoomInfo

ZoomInfo is the largest B2B contact database in the market, with particularly strong coverage in the US.

It is built to support outbound prospecting at scale through extensive firmographic, technographic, and intent data.

While ZoomInfo offers enrichment and visitor identification, these capabilities are secondary to its core outbound use case and often require additional modules.

Pros

Extensive contact and company database

Strong intent and technographic data

Well-suited for outbound SDR and sales teams

Cons

High and often unpredictable cost

Visitor identification is typically an add-on

Data decay concerns at scale

No native engagement or qualification layer

Pricing

Custom pricing, commonly high five-figure or six-figure annual contracts

Verdict

ZoomInfo is best used for outbound-heavy organizations focused on list building and prospecting. It is not suited for teams prioritizing inbound conversion or real-time engagement.

3. Demandbase

Demandbase is built around account-based marketing. It combines account data, intent signals, and advertising orchestration to support large ABM programs.

The platform excels at targeting and influencing accounts across channels, but is not designed to engage or qualify inbound visitors conversationally.

Pros

Strong account-level intelligence

Excellent ABM advertising and targeting capabilities

Useful for enterprise-scale marketing teams

Cons

High implementation complexity

Expensive and resource-intensive

Focused on influence rather than direct pipeline execution

No AI-driven qualification or routing

Pricing

Enterprise pricing and long-term contracts are common.

Verdict

Demandbase is best used when ABM advertising and account orchestration are the priority. It is not a fit for teams seeking autonomous inbound qualification or execution.

4. Warmly AI

Warmly focuses on identifying high-intent visitors and notifying sales teams in real time. It improves responsiveness by surfacing signals that would otherwise go unnoticed.

However, Warmly’s AI assists humans rather than acting autonomously. SDRs still manage qualification, routing, and follow-up.

Pros

Strong visitor identification and intent alerts

Improves the speed of human response

Useful for SDR-driven inbound workflows

Cons

AI is assistive, not autonomous

Relies heavily on SDR availability

Limited qualification depth

Becomes a bottleneck as volume increases

Pricing

Starts around ~$10K per year. Scales with usage and features.

Verdict

Warmly is best used by teams with active SDR coverage who want better intent visibility. It is not ideal for teams trying to reduce manual inbound workload.

5. RB2B

RB2B specializes in identifying individual visitors, primarily from US-based traffic. It is designed to give SDR teams fast access to names and roles behind anonymous visits.

The platform focuses narrowly on identification and does not offer enrichment depth, qualification logic, or execution workflows.

Pros

Person-level visitor identification

Useful for quick SDR follow-up

Simple to deploy

Cons

Limited to US traffic

No deep enrichment or automation

No qualification or routing layer

Not suitable for global teams

Pricing

Mid-range pricing, additional tools required for activation.

Verdict

RB2B is best used when SDR teams want quick person-level visibility for US traffic. It does not support end-to-end inbound revenue execution.

6. Snitcher

Snitcher provides simple company-level visitor identification using IP lookup. It is easy to deploy and affordable for teams that want basic visibility into website traffic.

Snitcher does not enrich data, engage visitors, or automate follow-up.

Pros

Easy setup

Low cost

Useful for basic traffic insights

Cons

Company-level data only

No enrichment or engagement

No automation or routing

Requires manual or external activation

Pricing

Low-cost, tiered pricing based on website traffic. Costs rise with volume, without added automation or enrichment.

Verdict

Snitcher is best used as an entry-level visibility tool. It is not suitable for teams aiming to convert inbound traffic into a pipeline automatically.

Comparison Table: Which Clearbit Alternative Actually Drives Revenue

This comparison looks beyond features and focuses on what each platform enables revenue teams to do next.

Specifically, whether it supports qualification and execution or stops at data and alerts.

Platform | Visitor Identification | AI-Based Qualification | Autonomous GTM Action | Best Fit For |

|---|---|---|---|---|

Breakout | Yes | Yes | Yes | Turning inbound traffic into qualified pipeline |

Clearbit | Yes | No | No | Data enrichment and form shortening |

ZoomInfo | Add-on | No | No | Outbound prospecting at scale |

Demandbase | Account-level | No | No | Account-based advertising and targeting |

Warmly | Yes | Limited | Limited | Intent alerts for SDR-led teams |

RB2B | Yes | No | No | Person-level visibility for SDR follow-up |

Snitcher | Company-level | No | No | Basic visitor identification |

Why Breakout Outperforms Clearbit for Inbound Revenue Execution

Most Clearbit alternatives focus on improving identification. Breakout focuses on improving conversion.

The distinction matters because inbound success is no longer about capturing data. It is about responding with relevance and speed.

What Breakout does differently:

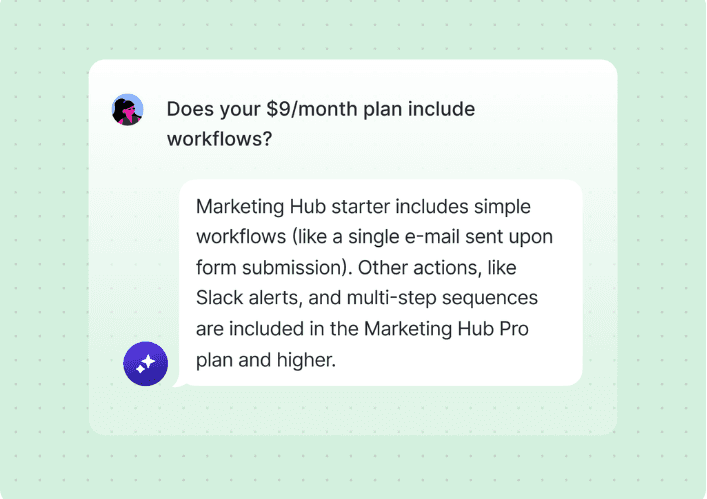

Real-time qualification without forms

Breakout engages visitors during the session and qualifies intent through conversation. This reduces drop-off and captures richer signals than static forms.

Execution is built into the system

By allowing AI to take action across CRM and sales tools, Breakout removes delays that often break inbound workflows.

This is especially valuable for RevOps leaders managing routing complexity, data consistency, and reporting accuracy.

One system instead of multiple tools

Breakout replaces the common pattern of enrichment, chat, routing plus SDR tooling. This reduces integration debt and simplifies ownership across teams.

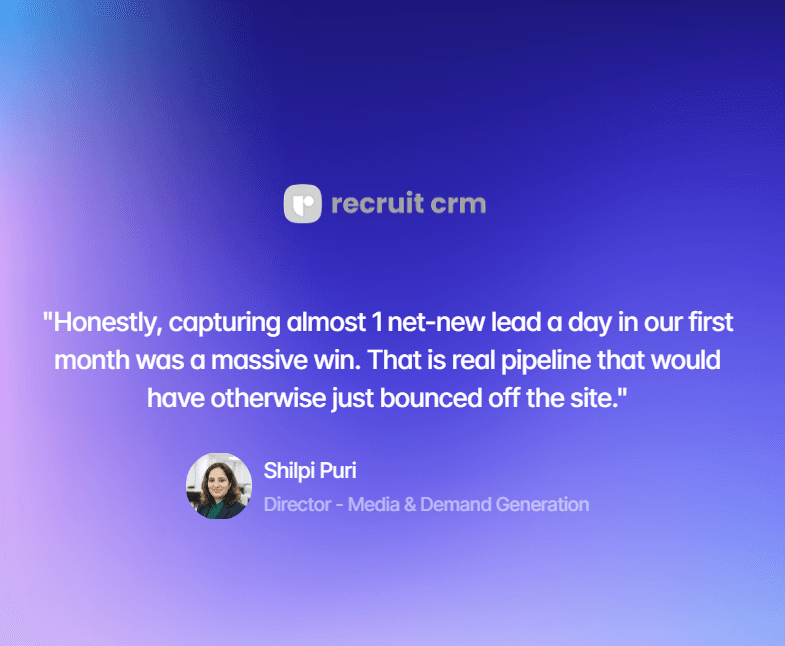

How this plays out in practice

Recruit CRM used Breakout to engage inbound visitors in real time and qualify intent automatically.

In the first month alone, Breakout engaged over 860 visitors and generated 50+ net-new pipeline opportunities from existing traffic.

For revenue teams, the takeaway is simple. Knowing who visited is no longer an advantage. Having a system that can qualify and act on intent before the moment passes is.

Final Thoughts

The most important question for teams evaluating Clearbit alternatives is simple.

What happens in the first few minutes after a high-intent buyer lands on your site?

If the answer involves waiting for a form submission, an alert, or manual follow-up, valuable intent is being lost.

In 2026, the strongest Clearbit alternative is not the platform with the most data points. It is the system that can recognize intent, qualify buyers, and move opportunities forward automatically.

If you want to see how Breakout turns inbound attention into qualified pipeline in real time, watch an AI SDR qualify and book meetings live.

FAQs

1. What are people using instead of Clearbit in 2026?

Most teams looking beyond Clearbit consider tools like Breakout, ZoomInfo, Demandbase, Warmly, RB2B, and Snitcher. The choice usually depends on whether the goal is data enrichment, outbound prospecting, ABM advertising, or converting inbound traffic into pipeline.

2. Is there a better alternative to Clearbit for inbound leads?

Yes, especially if inbound conversion is the priority. Tools like Breakout focus on acting on visitor data in real time by qualifying intent and moving opportunities forward, rather than stopping at enrichment.

3. Why are teams moving away from Clearbit?

Teams are not leaving Clearbit because the data is bad. Many move because enrichment alone does not create pipeline, costs increase with usage, and additional tools are still needed to engage and qualify visitors.

4. How does Breakout compare to Clearbit?

Clearbit identifies and enriches visitors. Breakout uses that information to engage buyers immediately through an AI SDR, qualify intent during the visit, and take action across CRM and sales tools automatically.

5. Is Clearbit pricing expensive for high-traffic websites?

It can be. Clearbit pricing is tied to data usage, so costs often rise as traffic increases. This becomes a concern when higher spending does not directly translate into more pipeline or revenue.

6. Can website visitor identification tools really replace lead forms?

They can reduce dependence on forms, but identification alone is not enough. Tools that combine identification with real-time conversations and qualification can capture intent without forcing early form fills.

7. How accurate is Clearbit data compared to other tools?

Clearbit is still considered highly accurate, but G2 reviews mention issues like outdated firmographics or incorrect matches at scale. Data quality varies depending on traffic volume and industry coverage.

8. What’s the difference between a data enrichment tool and an AI SDR platform?

A data enrichment tool tells you who the visitor is. An AI SDR platform uses that data to qualify buyers, route opportunities, update the CRM, and book meetings without manual intervention.

9. What should RevOps teams actually look for in a Clearbit alternative?

Beyond accuracy, RevOps teams should look at execution speed, CRM integration depth, automation reliability, pricing predictability, and how directly the tool contributes to pipeline creation.

10. When does it make sense to choose Breakout over Clearbit?

Breakout makes sense when inbound traffic is a core growth channel. It is designed for teams that want to qualify and act on buyer intent immediately, without forms, alerts, or manual SDR follow-up.